Debt Consolidation

Debt consolidation is about bringing your debts together so you only have to manage them in one place.

Bankruptcy is often seen as a last resort, and for many people facing overwhelming debt, it can feel like a frightening word. But in truth, bankruptcy is a legal way to wipe the slate clean and get a fresh start as long as you understand the consequences and how it works.

At the Advice Centre Group, we believe in giving you the full picture, without the jargon. So here’s what you need to know before considering bankruptcy.

Bankruptcy can offer a clean break from unmanageable debt, but it’s not without its consequences. Below are the main advantages and disadvantages to help you decide whether it’s the right solution for you.

Advantages:

Disadvantages:

Understanding the real-world impact of bankruptcy is essential. While it can offer powerful relief, it’s a decision that should be made with all the facts—and with the support of a professional adviser.. It’s not one-size-fits-all, and that’s why professional advice is essential.

Bankruptcy typically clears most unsecured debts, including:

Certain debts aren’t written off in bankruptcy, such as:

Understanding what debts remain after bankruptcy is crucial for planning your next steps.

Employment Impact Bankruptcy can affect your job if you work in certain professions, such as finance, law, or accountancy. You may be restricted from acting as a company director without the court’s permission.

Insolvency Register Your bankruptcy will be listed on the public Insolvency Register and will remain on your credit file for six years. This can impact your ability to access credit, rent a property, or secure certain types of employment.

Before deciding on bankruptcy, it’s essential to consider other debt solutions that might suit your situation better:

Debt Relief Orders (DROs) Designed for people with low income and few assets. It freezes debts for 12 months, after which they may be written off.

Individual Voluntary Arrangements (IVAs) A formal agreement to repay part of your debts over five to six years. It protects you from legal action and can offer more control over your assets.

Each option has its pros and cons, which is why getting expert advice is key.

At Advice Centre Group, we offer confidential, professional debt advice tailored to your circumstances. Whether you’re facing court action, struggling with overdue bills, or simply don’t know where to begin, we’re here to guide you.

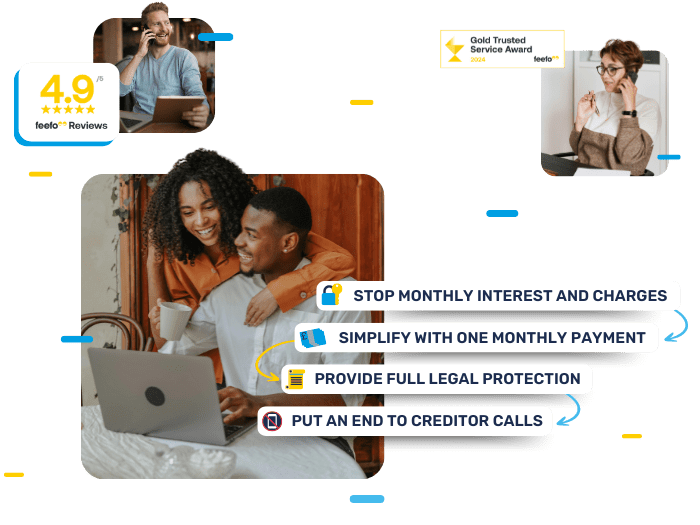

We have helped over 11,300+ people improve their financial well-being, with over 1,500 reviews and a 4.9-star rating. If you’re ready to take control of your finances and start fresh, see how we could help you today!

By submitting the above contact form you agree to be contacted by The Advice Centre regarding your enquiry. Your data will not be passed onto third parties without your consent.

Personal bankruptcies are a way for individuals to deal with debts they can’t afford. It’s a formal agreement between you and your creditors, and is designed to let you make a fresh start, free from debt, while ensuring your assets are shared among your creditors.

There is certainly some social stigma around declaring bankruptcy. However, debt solutions are designed to protect you when you most need the help. In most cases, any shame you may feel about the bankruptcy, feels a lot better than the constant stress and worry of being chased for outstanding debts.

It does clear HMRC debts, however, as with all creditors, they’ll try to get as much money back through selling off your assets before the remainder is cleared.

If the debtor files for bankruptcy, the debtor is responsible for paying for the bankruptcy, so they’ll need to have access to £680 in order to proceed. If one of your creditors files for your bankruptcy, they’ll pay for it themselves.

Bankruptcy is probably the most severe of the debt solutions available to you, mainly due to the requirements to sell off assets in order for your creditors to get as much of the money you owe. In that respect, it can look scary and losing some of your non-essential assets may require adjustment on your part, however, the ultimate objective is to get you debt-free and for that, adjustments are necessary.

If a creditor is petitioning for your bankruptcy and you owe less that £5000 in total, it’s highly likely not to be successful. That minimum debt thresh-hold doesn’t apply if you’re applying yourself. You may also be denied bankruptcy if the Official Receiver feels you’ve not been open and honest with your application.

{“type”:”elementor”,”siteurl”:”https://advicecentregroup.co.uk/wp-json/”,”elements”:[{“id”:”88d4b1c”,”elType”:”widget”,”isInner”:false,”isLocked”:false,”settings”:{“tabs”:[{“tab_title”:”What debts are wiped with bankruptcy?”,”tab_content”:”<p>Generally, unsecured debts are covered in your bankruptcy, debts such as credit cards, utility arrears, overdrafts, catalogue payments, store cards and overpayments of benefits. Debts generally not included are secured debts, fines and mortgages, as well as additional debts such as child maintenance arrears, student loans, court orders and TV licence arrears.</p>”,”_id”:”c30f845″},{“tab_title”:”How hard is it to recover from bankruptcies?”,”tab_content”:”<p>You’re right to be concerned about the recovery period after bankruptcies. Generally speaking, with a good recovery plan in place, the impact will be minimal. We’d advise you to monitor your credit report, avoid any further lines of expensive credit and follow a strict budget. Your credit file will take some years to recover, but with the right planning in place, you should have a clean file 6 years after the bankruptcy has ended.</p>”,”_id”:”045c0d5″},{“_id”:”cac2bf4″,”tab_title”:”Is IVA better than bankruptcy?”,”tab_content”:”<p>It’s a case of different horses for different courses. They’re really designed for helping people at different stages of the debt process. So while there are some comparisons, such as being formal arrangements that are aimed at clearing your debt, they work in different ways. With an IVA, your assets are preserved and protected, whereas with a bankruptcy, they’re not.</p>”},{“_id”:”b81b193″,”tab_title”:”How fast can you build your credit after bankruptcies?”,”tab_content”:”<p>Exiting bankruptcy does not immediately clear your credit file and once you’ve exited it, your debt commitments subsequent to the bankruptcy ending will define how quickly you can rebuild your credit. Unfortunately there’s no hard and fast rules and will depend entirely on your attitude to debt.</p>”},{“_id”:”bdb6d26″,”tab_title”:”Is a CCJ worse than a bankruptcy?”,”tab_content”:”<p>They are different things, unfortunately, so they can’t be compared. A CCJ can lead to a bankruptcy (if your creditors decide to attempt it) but it doesn’t work in reverse, a bankruptcy won’t lead to a CCJ. A CCJ is a judgement against you by the court and can lead to bailiffs visiting your home, whereas a bankruptcy is there to stop that happening (amon<span style=\”font-size: 14px;\”>g other things). The only place where a CCJ and bankruptcy are comparable is the effect they have on your credit rating. They both remain on your credit file for six years. It’s also possible a CCJ will have a lesser impact on securing work if your industry is regulated.</span></p>”},{“_id”:”b6802a9″,”tab_title”:”Does bankruptcy affect my job?”,”tab_content”:”<p>It certainly can affect your current and future career path. Bankruptcies generally only affect regulated trades, such as security, legal or finance, but if you’re unsure, you should definitely check with your employer.</p>”},{“_id”:”ba72da7″,”tab_title”:”Is filing bankruptcy stressful”,”tab_content”:”<p>The process itself can be fairly stressful, you’ll have to evidence your incomings, outgoings, debts and assets and there may be a bit of back and forth while the admin is arranged. However stressful setting up a bankruptcy is, once you’re in it, you’ll stop being chased by creditors, and can look forward to a future free of debt, in time. That rather offsets the stress of filing for bankruptcy.</p>”}],”border_width”:{“unit”:”px”,”size”:4,”sizes”:[]},”space_between”:{“unit”:”px”,”size”:0,”sizes”:[]},”_margin”:{“unit”:”px”,”top”:”0″,”right”:”0″,”bottom”:”0″,”left”:”0″,”isLinked”:false},”_element_width”:”initial”,”_element_custom_width”:{“unit”:”%”,”size”:44.821},”_margin_mobile”:{“unit”:”px”,”top”:”0″,”right”:”0″,”bottom”:”0″,”left”:”0″,”isLinked”:false},”_padding_mobile”:{“unit”:”px”,”top”:”0″,”right”:”0″,”bottom”:”0″,”left”:”0″,”isLinked”:false},”_element_custom_width_mobile”:{“unit”:”px”,”size”:337,”sizes”:[]},”__globals__”:{“border_color”:”globals/colors?id=uicore_accent”},”faq_schema”:””,”selected_icon”:{“value”:”fas fa-caret-right”,”library”:”fa-solid”},”selected_active_icon”:{“value”:”fas fa-caret-up”,”library”:”fa-solid”},”title_html_tag”:”div”,”border_color”:””,”space_between_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”space_between_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”box_shadow_box_shadow_type”:””,”box_shadow_box_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”spread”:0,”color”:”rgba(0,0,0,0.5)”},”box_shadow_box_shadow_position”:” “,”title_background”:””,”title_color”:””,”tab_active_color”:””,”title_typography_typography”:””,”title_typography_font_family”:””,”title_typography_font_size”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_font_size_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_font_size_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_font_weight”:””,”title_typography_text_transform”:””,”title_typography_font_style”:””,”title_typography_text_decoration”:””,”title_typography_line_height”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_line_height_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”title_typography_line_height_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”title_typography_letter_spacing”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_letter_spacing_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_letter_spacing_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_word_spacing”:{“unit”:”px”,”size”:””,”sizes”:[]},”title_typography_word_spacing_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”title_typography_word_spacing_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”title_shadow_text_shadow_type”:””,”title_shadow_text_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”color”:”rgba(0,0,0,0.3)”},”title_padding”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”title_padding_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”title_padding_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”icon_align”:”left”,”icon_color”:””,”icon_active_color”:””,”icon_space”:{“unit”:”px”,”size”:””,”sizes”:[]},”icon_space_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”icon_space_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_background_color”:””,”content_color”:””,”content_typography_typography”:””,”content_typography_font_family”:””,”content_typography_font_size”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_font_size_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_font_size_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_font_weight”:””,”content_typography_text_transform”:””,”content_typography_font_style”:””,”content_typography_text_decoration”:””,”content_typography_line_height”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_line_height_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”content_typography_line_height_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”content_typography_letter_spacing”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_letter_spacing_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_letter_spacing_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_word_spacing”:{“unit”:”px”,”size”:””,”sizes”:[]},”content_typography_word_spacing_tablet”:{“unit”:”em”,”size”:””,”sizes”:[]},”content_typography_word_spacing_mobile”:{“unit”:”em”,”size”:””,”sizes”:[]},”content_shadow_text_shadow_type”:””,”content_shadow_text_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”color”:”rgba(0,0,0,0.3)”},”content_padding”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”content_padding_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”content_padding_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_title”:””,”_margin_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_padding”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_padding_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_element_width_tablet”:””,”_element_width_mobile”:””,”_element_custom_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_grid_column”:””,”_grid_column_tablet”:””,”_grid_column_mobile”:””,”_grid_column_custom”:””,”_grid_column_custom_tablet”:””,”_grid_column_custom_mobile”:””,”_grid_row”:””,”_grid_row_tablet”:””,”_grid_row_mobile”:””,”_grid_row_custom”:””,”_grid_row_custom_tablet”:””,”_grid_row_custom_mobile”:””,”_flex_align_self”:””,”_flex_align_self_tablet”:””,”_flex_align_self_mobile”:””,”_flex_order”:””,”_flex_order_tablet”:””,”_flex_order_mobile”:””,”_flex_order_custom”:””,”_flex_order_custom_tablet”:””,”_flex_order_custom_mobile”:””,”_flex_size”:””,”_flex_size_tablet”:””,”_flex_size_mobile”:””,”_flex_grow”:1,”_flex_grow_tablet”:””,”_flex_grow_mobile”:””,”_flex_shrink”:1,”_flex_shrink_tablet”:””,”_flex_shrink_mobile”:””,”_element_vertical_align”:””,”_element_vertical_align_tablet”:””,”_element_vertical_align_mobile”:””,”_position”:””,”_offset_orientation_h”:”start”,”_offset_x”:{“unit”:”px”,”size”:0,”sizes”:[]},”_offset_x_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_x_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_x_end”:{“unit”:”px”,”size”:0,”sizes”:[]},”_offset_x_end_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_x_end_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_orientation_v”:”start”,”_offset_y”:{“unit”:”px”,”size”:0,”sizes”:[]},”_offset_y_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_y_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_y_end”:{“unit”:”px”,”size”:0,”sizes”:[]},”_offset_y_end_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_offset_y_end_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_z_index”:””,”_z_index_tablet”:””,”_z_index_mobile”:””,”_element_id”:””,”_css_classes”:””,”e_display_conditions”:””,”_element_cache”:””,”motion_fx_motion_fx_scrolling”:””,”motion_fx_translateY_effect”:””,”motion_fx_translateY_direction”:””,”motion_fx_translateY_speed”:{“unit”:”px”,”size”:4,”sizes”:[]},”motion_fx_translateY_affectedRange”:{“unit”:”%”,”size”:””,”sizes”:{“start”:0,”end”:100}},”motion_fx_translateX_effect”:””,”motion_fx_translateX_direction”:””,”motion_fx_translateX_speed”:{“unit”:”px”,”size”:4,”sizes”:[]},”motion_fx_translateX_affectedRange”:{“unit”:”%”,”size”:””,”sizes”:{“start”:0,”end”:100}},”motion_fx_opacity_effect”:””,”motion_fx_opacity_direction”:”out-in”,”motion_fx_opacity_level”:{“unit”:”px”,”size”:10,”sizes”:[]},”motion_fx_opacity_range”:{“unit”:”%”,”size”:””,”sizes”:{“start”:20,”end”:80}},”motion_fx_blur_effect”:””,”motion_fx_blur_direction”:”out-in”,”motion_fx_blur_level”:{“unit”:”px”,”size”:7,”sizes”:[]},”motion_fx_blur_range”:{“unit”:”%”,”size”:””,”sizes”:{“start”:20,”end”:80}},”motion_fx_rotateZ_effect”:””,”motion_fx_rotateZ_direction”:””,”motion_fx_rotateZ_speed”:{“unit”:”px”,”size”:1,”sizes”:[]},”motion_fx_rotateZ_affectedRange”:{“unit”:”%”,”size”:””,”sizes”:{“start”:0,”end”:100}},”motion_fx_scale_effect”:””,”motion_fx_scale_direction”:”out-in”,”motion_fx_scale_speed”:{“unit”:”px”,”size”:4,”sizes”:[]},”motion_fx_scale_range”:{“unit”:”%”,”size”:””,”sizes”:{“start”:20,”end”:80}},”motion_fx_transform_origin_x”:”center”,”motion_fx_transform_origin_y”:”center”,”motion_fx_devices”:[“desktop”,”tablet”,”mobile”],”motion_fx_range”:””,”motion_fx_motion_fx_mouse”:””,”motion_fx_mouseTrack_effect”:””,”motion_fx_mouseTrack_direction”:””,”motion_fx_mouseTrack_speed”:{“unit”:”px”,”size”:1,”sizes”:[]},”motion_fx_tilt_effect”:””,”motion_fx_tilt_direction”:””,”motion_fx_tilt_speed”:{“unit”:”px”,”size”:4,”sizes”:[]},”handle_motion_fx_asset_loading”:””,”sticky”:””,”sticky_on”:[“desktop”,”tablet”,”mobile”],”sticky_offset”:0,”sticky_offset_tablet”:””,”sticky_offset_mobile”:””,”sticky_effects_offset”:0,”sticky_effects_offset_tablet”:””,”sticky_effects_offset_mobile”:””,”sticky_anchor_link_offset”:0,”sticky_anchor_link_offset_tablet”:””,”sticky_anchor_link_offset_mobile”:””,”sticky_parent”:””,”_animation”:””,”_animation_tablet”:””,”_animation_mobile”:””,”animation_duration”:””,”_animation_delay”:””,”_transform_rotate_popover”:””,”_transform_rotateZ_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateZ_effect_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateZ_effect_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotate_3d”:””,”_transform_rotateX_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateX_effect_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateX_effect_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateY_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateY_effect_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateY_effect_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_perspective_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_perspective_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_perspective_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translate_popover”:””,”_transform_translateX_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateX_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateX_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_popover”:””,”_transform_keep_proportions”:”yes”,”_transform_scale_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skew_popover”:””,”_transform_skewX_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skewX_effect_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewX_effect_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewY_effect”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skewY_effect_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewY_effect_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_flipX_effect”:””,”_transform_flipY_effect”:””,”_transform_rotate_popover_hover”:””,”_transform_rotateZ_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateZ_effect_hover_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateZ_effect_hover_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotate_3d_hover”:””,”_transform_rotateX_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateX_effect_hover_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateX_effect_hover_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateY_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_rotateY_effect_hover_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_rotateY_effect_hover_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_perspective_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_perspective_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_perspective_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translate_popover_hover”:””,”_transform_translateX_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateX_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateX_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_translateY_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_popover_hover”:””,”_transform_keep_proportions_hover”:”yes”,”_transform_scale_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scale_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleX_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect_hover_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_scaleY_effect_hover_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skew_popover_hover”:””,”_transform_skewX_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skewX_effect_hover_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewX_effect_hover_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewY_effect_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”_transform_skewY_effect_hover_tablet”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_skewY_effect_hover_mobile”:{“unit”:”deg”,”size”:””,”sizes”:[]},”_transform_flipX_effect_hover”:””,”_transform_flipY_effect_hover”:””,”_transform_transition_hover”:{“unit”:”px”,”size”:””,”sizes”:[]},”motion_fx_transform_x_anchor_point”:””,”motion_fx_transform_x_anchor_point_tablet”:””,”motion_fx_transform_x_anchor_point_mobile”:””,”motion_fx_transform_y_anchor_point”:””,”motion_fx_transform_y_anchor_point_tablet”:””,”motion_fx_transform_y_anchor_point_mobile”:””,”_background_background”:””,”_background_color”:””,”_background_color_stop”:{“unit”:”%”,”size”:0,”sizes”:[]},”_background_color_stop_tablet”:{“unit”:”%”},”_background_color_stop_mobile”:{“unit”:”%”},”_background_color_b”:”#f2295b”,”_background_color_b_stop”:{“unit”:”%”,”size”:100,”sizes”:[]},”_background_color_b_stop_tablet”:{“unit”:”%”},”_background_color_b_stop_mobile”:{“unit”:”%”},”_background_gradient_type”:”linear”,”_background_gradient_angle”:{“unit”:”deg”,”size”:180,”sizes”:[]},”_background_gradient_angle_tablet”:{“unit”:”deg”},”_background_gradient_angle_mobile”:{“unit”:”deg”},”_background_gradient_position”:”center center”,”_background_gradient_position_tablet”:””,”_background_gradient_position_mobile”:””,”_background_image”:{“url”:””,”id”:””,”size”:””},”_background_image_tablet”:{“url”:””,”id”:””,”size”:””},”_background_image_mobile”:{“url”:””,”id”:””,”size”:””},”_background_position”:””,”_background_position_tablet”:””,”_background_position_mobile”:””,”_background_xpos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_xpos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_xpos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_ypos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_ypos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_ypos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_attachment”:””,”_background_repeat”:””,”_background_repeat_tablet”:””,”_background_repeat_mobile”:””,”_background_size”:””,”_background_size_tablet”:””,”_background_size_mobile”:””,”_background_bg_width”:{“unit”:”%”,”size”:100,”sizes”:[]},”_background_bg_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_background_bg_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_background_video_link”:””,”_background_video_start”:””,”_background_video_end”:””,”_background_play_once”:””,”_background_play_on_mobile”:””,”_background_privacy_mode”:””,”_background_video_fallback”:{“url”:””,”id”:””,”size”:””},”_background_slideshow_gallery”:[],”_background_slideshow_loop”:”yes”,”_background_slideshow_slide_duration”:5000,”_background_slideshow_slide_transition”:”fade”,”_background_slideshow_transition_duration”:500,”_background_slideshow_background_size”:””,”_background_slideshow_background_size_tablet”:””,”_background_slideshow_background_size_mobile”:””,”_background_slideshow_background_position”:””,”_background_slideshow_background_position_tablet”:””,”_background_slideshow_background_position_mobile”:””,”_background_slideshow_lazyload”:””,”_background_slideshow_ken_burns”:””,”_background_slideshow_ken_burns_zoom_direction”:”in”,”_background_hover_background”:””,”_background_hover_color”:””,”_background_hover_color_stop”:{“unit”:”%”,”size”:0,”sizes”:[]},”_background_hover_color_stop_tablet”:{“unit”:”%”},”_background_hover_color_stop_mobile”:{“unit”:”%”},”_background_hover_color_b”:”#f2295b”,”_background_hover_color_b_stop”:{“unit”:”%”,”size”:100,”sizes”:[]},”_background_hover_color_b_stop_tablet”:{“unit”:”%”},”_background_hover_color_b_stop_mobile”:{“unit”:”%”},”_background_hover_gradient_type”:”linear”,”_background_hover_gradient_angle”:{“unit”:”deg”,”size”:180,”sizes”:[]},”_background_hover_gradient_angle_tablet”:{“unit”:”deg”},”_background_hover_gradient_angle_mobile”:{“unit”:”deg”},”_background_hover_gradient_position”:”center center”,”_background_hover_gradient_position_tablet”:””,”_background_hover_gradient_position_mobile”:””,”_background_hover_image”:{“url”:””,”id”:””,”size”:””},”_background_hover_image_tablet”:{“url”:””,”id”:””,”size”:””},”_background_hover_image_mobile”:{“url”:””,”id”:””,”size”:””},”_background_hover_position”:””,”_background_hover_position_tablet”:””,”_background_hover_position_mobile”:””,”_background_hover_xpos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_xpos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_xpos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_ypos”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_ypos_tablet”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_ypos_mobile”:{“unit”:”px”,”size”:0,”sizes”:[]},”_background_hover_attachment”:””,”_background_hover_repeat”:””,”_background_hover_repeat_tablet”:””,”_background_hover_repeat_mobile”:””,”_background_hover_size”:””,”_background_hover_size_tablet”:””,”_background_hover_size_mobile”:””,”_background_hover_bg_width”:{“unit”:”%”,”size”:100,”sizes”:[]},”_background_hover_bg_width_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_background_hover_bg_width_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_background_hover_video_link”:””,”_background_hover_video_start”:””,”_background_hover_video_end”:””,”_background_hover_play_once”:””,”_background_hover_play_on_mobile”:””,”_background_hover_privacy_mode”:””,”_background_hover_video_fallback”:{“url”:””,”id”:””,”size”:””},”_background_hover_slideshow_gallery”:[],”_background_hover_slideshow_loop”:”yes”,”_background_hover_slideshow_slide_duration”:5000,”_background_hover_slideshow_slide_transition”:”fade”,”_background_hover_slideshow_transition_duration”:500,”_background_hover_slideshow_background_size”:””,”_background_hover_slideshow_background_size_tablet”:””,”_background_hover_slideshow_background_size_mobile”:””,”_background_hover_slideshow_background_position”:””,”_background_hover_slideshow_background_position_tablet”:””,”_background_hover_slideshow_background_position_mobile”:””,”_background_hover_slideshow_lazyload”:””,”_background_hover_slideshow_ken_burns”:””,”_background_hover_slideshow_ken_burns_zoom_direction”:”in”,”_background_hover_transition”:{“unit”:”px”,”size”:””,”sizes”:[]},”_border_border”:””,”_border_width”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_width_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_width_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_color”:””,”_border_radius”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_radius_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_radius_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_box_shadow_box_shadow_type”:””,”_box_shadow_box_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”spread”:0,”color”:”rgba(0,0,0,0.5)”},”_box_shadow_box_shadow_position”:” “,”_border_hover_border”:””,”_border_hover_width”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_hover_width_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_hover_width_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_hover_color”:””,”_border_radius_hover”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_radius_hover_tablet”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_border_radius_hover_mobile”:{“unit”:”px”,”top”:””,”right”:””,”bottom”:””,”left”:””,”isLinked”:true},”_box_shadow_hover_box_shadow_type”:””,”_box_shadow_hover_box_shadow”:{“horizontal”:0,”vertical”:0,”blur”:10,”spread”:0,”color”:”rgba(0,0,0,0.5)”},”_box_shadow_hover_box_shadow_position”:” “,”_border_hover_transition”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_switch”:””,”_mask_shape”:”circle”,”_mask_image”:{“url”:””,”id”:””,”size”:””},”_mask_notice”:””,”_mask_size”:”contain”,”_mask_size_tablet”:””,”_mask_size_mobile”:””,”_mask_size_scale”:{“unit”:”%”,”size”:100,”sizes”:[]},”_mask_size_scale_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_size_scale_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_position”:”center center”,”_mask_position_tablet”:””,”_mask_position_mobile”:””,”_mask_position_x”:{“unit”:”%”,”size”:0,”sizes”:[]},”_mask_position_x_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_position_x_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_position_y”:{“unit”:”%”,”size”:0,”sizes”:[]},”_mask_position_y_tablet”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_position_y_mobile”:{“unit”:”px”,”size”:””,”sizes”:[]},”_mask_repeat”:”no-repeat”,”_mask_repeat_tablet”:””,”_mask_repeat_mobile”:””,”hide_desktop”:””,”hide_tablet”:””,”hide_mobile”:””,”_attributes”:””,”custom_css”:””},”defaultEditSettings”:{“defaultEditRoute”:”content”},”elements”:[],”widgetType”:”toggle”,”editSettings”:{“defaultEditRoute”:”content”,”panel”:{“activeTab”:”content”,”activeSection”:”section_toggle”},”activeItemIndex”:1}}]}Yes, it’s perfectly possible, and it should be easier than your pre-bankruptcy spending habits. Be prepared to budget tightly, and follow practical advice for rebuilding your credit file.

Generally, unsecured debts are covered in your bankruptcy, debts such as credit cards, utility arrears, overdrafts, catalogue payments, store cards and overpayments of benefits. Debts generally not included are secured debts, fines and mortgages, as well as additional debts such as child maintenance arrears, student loans, court orders and TV licence arrears.

You’re right to be concerned about the recovery period after bankruptcies. Generally speaking, with a good recovery plan in place, the impact will be minimal. We’d advise you to monitor your credit report, avoid any further lines of expensive credit and follow a strict budget. Your credit file will take some years to recover, but with the right planning in place, you should have a clean file 6 years after the bankruptcy has ended.

It’s a case of different horses for different courses. They’re really designed for helping people at different stages of the debt process. So while there are some comparisons, such as being formal arrangements that are aimed at clearing your debt, they work in different ways. With an IVA, your assets are preserved and protected, whereas with a bankruptcy, they’re not.

Exiting bankruptcy does not immediately clear your credit file and once you’ve exited it, your debt commitments subsequent to the bankruptcy ending will define how quickly you can rebuild your credit. Unfortunately there’s no hard and fast rules and will depend entirely on your attitude to debt.

They are different things, unfortunately, so they can’t be compared. A CCJ can lead to a bankruptcy (if your creditors decide to attempt it) but it doesn’t work in reverse, a bankruptcy won’t lead to a CCJ. A CCJ is a judgement against you by the court and can lead to bailiffs visiting your home, whereas a bankruptcy is there to stop that happening (among other things). The only place where a CCJ and bankruptcy are comparable is the effect they have on your credit rating. They both remain on your credit file for six years. It’s also possible a CCJ will have a lesser impact on securing work if your industry is regulated.

It certainly can affect your current and future career path. Bankruptcies generally only affect regulated trades, such as security, legal or finance, but if you’re unsure, you should definitely check with your employer.

The process itself can be fairly stressful, you’ll have to evidence your incomings, outgoings, debts and assets and there may be a bit of back and forth while the admin is arranged. However stressful setting up a bankruptcy is, once you’re in it, you’ll stop being chased by creditors, and can look forward to a future free of debt, in time. That rather offsets the stress of filing for bankruptcy.

Debt consolidation is about bringing your debts together so you only have to manage them in one place.

Breathing Space, is a government initiative in England and Wales that gives people temporary protection from creditor action.

Yes – In Short, Bailiffs can refuse payment plans, However there are options available to help you.

Call us – 0161 768 8403

Email us – Enquiries@advicecentregroup.co.uk

You can visit the Money Helper website to find out more about managing your money and to get free advice, they are an independent service set up to help people manage their money

Advice Centre Group Ltd registered in England and Wales (14322979). Registered office: Second Floor A, Cheadle Place, Cheadle, Cheshire, England, SK8 2JX.

Adam Southard is authorised as a Licensed Insolvency Practitioner in the United Kingdom by the Insolvency Practitioners Association, We only provide advice after completing or receiving an initial fact find where the individual(s) concerned meet the criteria for one of our insolvency solutions, therefore, all advice regarding Individual Voluntary Arrangements (IVA) is given in reasonable contemplation of an insolvency appointment.

Adam Southard is licensed to act as an Insolvency Practitioner in the UK by the Insolvency Practitioners Association. Office Holder No. 11930

Insolvency Practitioner Directory- Insolvency Practitioner Details (bis.gov.uk)

What you need to know about Individual Voluntary Arrangements

(Insolvency Service)

We provide solutions to individuals throughout the UK, We Will help recommend solutions available to your circumstances in which you can then make an informed decision about which solution you qualify for is best for you and your circumstances.