Bankruptcy In UK

Bankruptcy is often seen as a last resort, and for many people facing overwhelming debt, it can feel like a frightening word.

An Individual Voluntary Arrangement (IVA) is a formal and legally binding agreement between you and your creditors to pay back your debts over a period of time. It’s designed to help you manage your debts when they are unaffordable, by entering into an agreement with your creditors to repay all or part of your debt over the space of 5-6 years. You gain legal protection, providing you keep up your payments, and your creditors will stop chasing the debt and applying further fees and charges.

An IVA is a legally binding debt solution designed to help manage your finances. Once your creditors agree to its terms:

An IVA can help with some debts, but not all of them. It’s important to know which debts can be included and which ones you’ll still need to pay separately. This will help you make the best decision for your finances.

However, some debts cannot be included in an IVA. These are usually ‘secured’ debts, It’s important to keep up with these payments to avoid further financial difficulties.

An IVA involves a single, affordable monthly payment based on your financial situation. This payment is distributed among your creditors. Once the IVA is completed, any remaining debt is written off, allowing you to start a debt-free future.

If managing your debt feels overwhelming, an IVA could provide the structured solution you need. Take the first step towards financial wellbeing and find out if it’s the right choice for you.

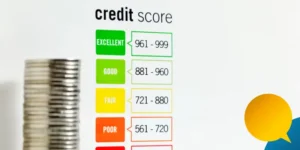

An IVA will stay on your credit report for six years, and your details will be added to the public Register of Insolvencies during the plan. However, it provides you with an excellent opportunity to clear your debts and move towards financial freedom.

An IVA is open to residents of England, Wales and Northern Ireland.

By submitting the above contact form you agree to be contacted by The Advice Centre regarding your enquiry. Your data will not be passed onto third parties without your consent.

Bankruptcy is often seen as a last resort, and for many people facing overwhelming debt, it can feel like a frightening word.

Some debts need to be dealt with immediately to avoid serious consequences. Others, while still important, don’t carry the same urgency.

Concerned about your credit rating after entering an IVA? This guide explains what to expect and how to take control of your financial future.

Call us – 0161 768 8403

Email us – Enquiries@advicecentregroup.co.uk

You can visit the Money Helper website to find out more about managing your money and to get free advice, they are an independent service set up to help people manage their money

Advice Centre Group Ltd registered in England and Wales (14322979). Registered office: Second Floor A, Cheadle Place, Cheadle, Cheshire, England, SK8 2JX.

Adam Southard is authorised as a Licensed Insolvency Practitioner in the United Kingdom by the Insolvency Practitioners Association, We only provide advice after completing or receiving an initial fact find where the individual(s) concerned meet the criteria for one of our insolvency solutions, therefore, all advice regarding Individual Voluntary Arrangements (IVA) is given in reasonable contemplation of an insolvency appointment.

Adam Southard is licensed to act as an Insolvency Practitioner in the UK by the Insolvency Practitioners Association. Office Holder No. 11930

Insolvency Practitioner Directory- Insolvency Practitioner Details (bis.gov.uk)

What you need to know about Individual Voluntary Arrangements

(Insolvency Service)

We provide solutions to individuals throughout the UK, We Will help recommend solutions available to your circumstances in which you can then make an informed decision about which solution you qualify for is best for you and your circumstances.