Debt Consolidation

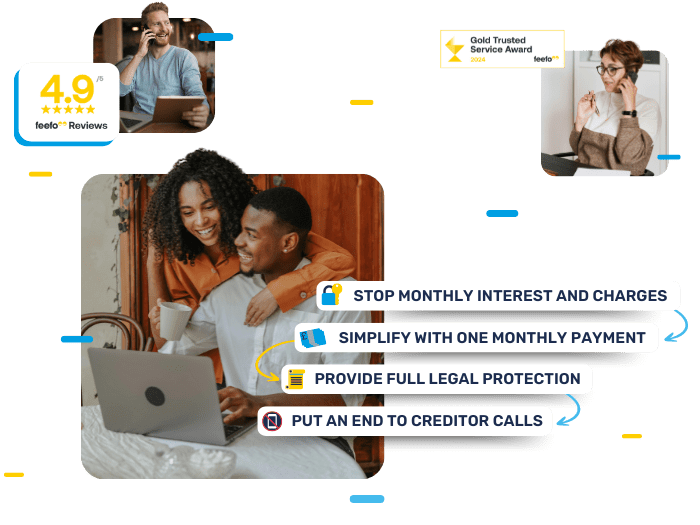

Debt consolidation is about bringing your debts together so you only have to manage them in one place.

When you’re juggling multiple debts, it can feel like every creditor is shouting for attention. The pressure builds, and it becomes hard to know where to start. At the Advice Centre Group, we’ve helped over 12,125 people find clarity in financial chaos—and one of the most important lessons is this: not all debts are created equal.

Some debts need to be dealt with immediately to avoid serious consequences. Others, while still important, don’t carry the same urgency. This blog will help you understand how to prioritise your debts effectively so you can take control with confidence.

All debts fall into one of two categories:

Let’s explore both in more detail.

These debts should be your top focus. Here’s what falls under this category:

Your home is on the line. If you miss payments, landlords or mortgage lenders can initiate eviction or repossession.

Unpaid council tax can lead to court summons, enforcement agents, and even imprisonment in extreme cases.

Energy providers can cut off your supply if payments aren’t made. Payment plans are often available, but communication is key.

You can’t be disconnected in the UK, but unpaid water bills can still result in enforcement action.

These are enforced by the courts and carry severe consequences if left unpaid. Bailiffs and wage deductions are possible.

HMRC has powerful collection tools, including seizing assets or garnishing wages. These debts should never be ignored.

Non-payment can result in legal action, deductions from wages or benefits, and travel restrictions.

If you’re a sole trader or personally guaranteed a loan, these can have a direct impact on your personal finances.

If you’ve taken out a priority loan with someone else, you’re both equally responsible. You could be liable for the full amount if the other party doesn’t pay.

While these debts won’t typically result in loss of your home or immediate legal trouble, they can still cause long-term financial issues.

Missed payments will impact your credit score and may lead to CCJs, but this typically takes time.

Important to repay, but lenders usually pursue recovery through the courts over time.

Often come with high interest rates, which can spiral quickly. Important to manage, but rarely lead to immediate legal action.

These can lead to defaults and affect your credit history, especially with the rise of BNPL services.

Usually collected by your bank. Persistent use can harm your credit score, but it’s a lower priority compared to essential bills.

Non-payment can lead to disconnection and collections activity, but they don’t threaten your home or freedom.

Not legally enforceable unless formalised. Still emotionally significant and worth resolving, but less urgent from a legal standpoint.

These are income-based and are often written off after a number of years. They don’t affect your credit file and are not considered priority debts.

At Advice Centre Group, we offer confidential, professional debt advice tailored to your circumstances. Whether you’re facing court action, struggling with overdue bills, or simply don’t know where to begin, we’re here to guide you.

We have helped over 12,125+ people improve their financial well-being, with over 1,600 reviews and a 4.9-star rating. If you’re ready to take control of your finances and start fresh, see how an IVA could help you today!

By submitting the above contact form you agree to be contacted by The Advice Centre regarding your enquiry. Your data will not be passed onto third parties without your consent.

Priority debts are the ones that carry the most serious consequences if left unpaid. This includes things like rent or mortgage arrears, council tax, child maintenance, gas and electricity bills. Non-priority debts include things like credit cards, overdrafts, and personal loans. The difference is not about the size of the debt but the consequences of not paying. (MoneyHelper)

If you are struggling to tell which debts are urgent, we can help you review your situation and guide you through the next steps.

If you ignore priority debts, the consequences can be serious. You could face losing your home, losing essential services, or even court action. That is why it is important to deal with these debts first, even if the amounts seem smaller than your credit cards or loans.

If you feel overwhelmed, we can help you put a plan in place so that your most important bills are managed safely.

Yes, they can in certain circumstances. For example, if you stop paying council tax or utility bills, you may eventually face enforcement action or bailiffs, which makes them urgent. The same applies if a non-priority debt goes to court and you receive a judgment. (Citizens Advice PDF)

It is best to cover your living costs first, then your priority debts, then your non-priority debts. That way you protect your home, your family, and your essential services. If you cannot pay everything, make sure you do not ignore the debts with the biggest consequences.

If you are not sure how to prioritise, we are a team who can help you review your finances and take the pressure off.

No, they do not. Some solutions, like IVAs or DROs, focus mainly on non-priority debts. Priority debts may still need separate arrangements or ongoing payments. Bankruptcy may cover both, but the outcomes can vary. This is why understanding the difference matters before you commit to a solution.

If you are unsure which solution fits your situation, we can help you explore the options confidentially.

If you genuinely cannot afford to pay, do not ignore them. Contacting your creditor to explain the situation may help, but it is better to get support so you do not have to do this alone. In many cases, repayment arrangements or formal solutions can prevent matters from escalating.

If you feel trapped by priority debts, reach out to us. We are a team and we can help you take back control.

Debt consolidation is about bringing your debts together so you only have to manage them in one place.

Breathing Space, is a government initiative in England and Wales that gives people temporary protection from creditor action.

Yes – In Short, Bailiffs can refuse payment plans, However there are options available to help you.

Call us – 0161 768 8403

Email us – Enquiries@advicecentregroup.co.uk

You can visit the Money Helper website to find out more about managing your money and to get free advice, they are an independent service set up to help people manage their money

Advice Centre Group Ltd registered in England and Wales (14322979). Registered office: Second Floor A, Cheadle Place, Cheadle, Cheshire, England, SK8 2JX.

Adam Southard is authorised as a Licensed Insolvency Practitioner in the United Kingdom by the Insolvency Practitioners Association, We only provide advice after completing or receiving an initial fact find where the individual(s) concerned meet the criteria for one of our insolvency solutions, therefore, all advice regarding Individual Voluntary Arrangements (IVA) is given in reasonable contemplation of an insolvency appointment.

Adam Southard is licensed to act as an Insolvency Practitioner in the UK by the Insolvency Practitioners Association. Office Holder No. 11930

Insolvency Practitioner Directory- Insolvency Practitioner Details (bis.gov.uk)

What you need to know about Individual Voluntary Arrangements

(Insolvency Service)

We provide solutions to individuals throughout the UK, We Will help recommend solutions available to your circumstances in which you can then make an informed decision about which solution you qualify for is best for you and your circumstances.