Debt Consolidation

Debt consolidation is about bringing your debts together so you only have to manage them in one place.

An Individual Voluntary Arrangement (IVA) is a debt solution designed for those struggling to repay their debts. Rather than repaying the full amount, an IVA allows you to make manageable payments over a set period, helping you regain financial stability.

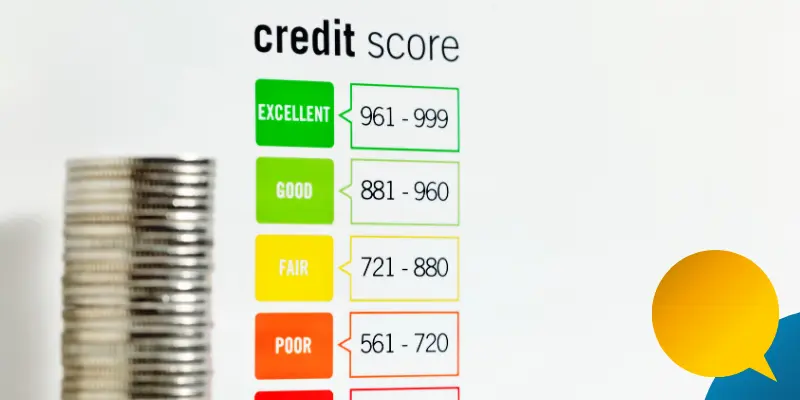

While an IVA does impact your credit score, so does having unpaid debts. If you’re struggling to keep up with payments, an IVA might be the fresh start you need. Instead of dealing with mounting debt and missed payments, an IVA helps you take control and work toward becoming debt-free.

Setting up an IVA means agreeing to repay a manageable portion of your debt over a set period, usually five to six years. At the end of the agreement, any remaining debt covered by the IVA is legally written off. This structured approach allows individuals to regain financial stability while avoiding more severe consequences, such as bankruptcy.

An IVA is recorded on your credit file, which lowers your credit score. However, if you already have missed payments, defaults, or County Court Judgments (CCJs), your score may already be impacted. An IVA helps you deal with debt in a structured way, which can be beneficial in the long run.

While your credit options will be limited, using this period to build better financial habits can help in the long term

An IVA stays on your credit file for six years from the start date, even if you complete payments early. This can make borrowing money more difficult during this time, but once it’s removed, you have the opportunity to rebuild your credit profile.

While an IVA can make obtaining credit difficult during this period, once removed, you can begin working toward a healthier financial future.

Rebuilding your credit after an IVA requires patience and careful financial management. Taking the right steps can improve your credit rating over time.

We have helped over 11,300+ people improve their financial well-being, with over 1,500 reviews and a 4.9-star rating. If you’re ready to take control of your finances and start fresh, see how an IVA could help you today!

Name changed for privacy*

By submitting the above contact form you agree to be contacted by The Advice Centre regarding your enquiry. Your data will not be passed onto third parties without your consent.

You can’t miss payments or take out any credit over £500 without permission from your IP (insolvency practitioner)

Falling fouls of the terms of the contract, such as missing payments, not selling an asset previously agreed, or paying in a percentage of additional income you earn. These can all result in the IVA failing and your creditors potentially filing for your bankruptcy.

On an IVA, you’re free to go about your daily life, your IP should not deny you access to holidays, and having one can be a huge boost to your mental well-being. That being said, just ensure you pay your monthly payments and bills.

Your IVA repayment will be based on a number of factors, including your living expenses. Once your IVA repayments and any outstanding bills are paid, you’re free to use the money left however you see fit.

Once all your incomings and expenditure are accounted for (not including creditor debts), providing you have more than £90 per month that you can afford to use to repay your debts through an IVA, you’ll be eligible for one (subject to other criteria). It should however be highlighted that you’ll be expected to pay more if you can afford more. The base minimum would be £90 per month.

You are free to spend your money any way you wish once your repayment and bills have been accounted for. However, if you’re using finance to buy a car, please be aware that any credit over £500 will need to be signed off by your IP

Unfortunately, there is no such thing as a universal credit rating, and all lenders have different threshholds for what they consider to be a servicable debt, which will be based on a number of factors, including the credit rating at whichever credit reference agency they use. It’s likely that you’ll find it more difficult to pass a credit check than if you didn’t have an IVA, but by no means is it impossible and your IVA will be only one factor they use to offer you credit.

One (of many) advantage of an IVA is that creditors will stop chasing you for debt, this can mean a huge weight off your mind. My own favourite is that after the length of the IVA, you’re completely free of debt.

Providing your debts are not criminal debts such as unpaid court fines, or student loans or child support, they can generally be included within your IVA and your IP will contact the bailiff to get them to stand down.

There’s no maximum debt level for an IVA, they are designed for people owing over £5,000 but have no upper limit.

It is possible to exit an IVA early, for example, you may receive a windfall, such as a lottery win or inheritance. You should be aware though, that a windfall needs to be brought to your IPs attention as it’s considered an asset. The other way to exit early would be if a third-party, such as a friend, offered to pay your IVA off as a gift, this would not be considered an asset, and may allow you to pay off your IVA at an earlier date.

Once all your incomings and expenditure are accounted for (not including creditor debts), providing you have more than £90 per month that you can afford to use to repay your debts through an IVA, you’ll be eligible for one, at least as far as income goes. It should however be highlighted that you’ll be expected to pay more if you can afford more. The base minimum would be £90 per month.

Under most ciscumstances, within an IVA, you’re allowed to borrow upto £500 before notifying your IP. However, you should also be aware that this limit is cumulative, So if you’ve already borrowed a total of £499, you can’t apply for another £499 without notifying your IP

During the application process, you IP will check your credit file and require proof of income, which will include bank statements, but once the IVA is in place, an IP generally wouldn’t need to check your accounts. This may change during your annual review if your IP suspects you’re not declaring something.

Debt consolidation is about bringing your debts together so you only have to manage them in one place.

Breathing Space, is a government initiative in England and Wales that gives people temporary protection from creditor action.

Yes – In Short, Bailiffs can refuse payment plans, However there are options available to help you.

Call us – 0161 768 8403

Email us – Enquiries@advicecentregroup.co.uk

You can visit the Money Helper website to find out more about managing your money and to get free advice, they are an independent service set up to help people manage their money

Advice Centre Group Ltd registered in England and Wales (14322979). Registered office: Second Floor A, Cheadle Place, Cheadle, Cheshire, England, SK8 2JX.

Adam Southard is authorised as a Licensed Insolvency Practitioner in the United Kingdom by the Insolvency Practitioners Association, We only provide advice after completing or receiving an initial fact find where the individual(s) concerned meet the criteria for one of our insolvency solutions, therefore, all advice regarding Individual Voluntary Arrangements (IVA) is given in reasonable contemplation of an insolvency appointment.

Adam Southard is licensed to act as an Insolvency Practitioner in the UK by the Insolvency Practitioners Association. Office Holder No. 11930

Insolvency Practitioner Directory- Insolvency Practitioner Details (bis.gov.uk)

What you need to know about Individual Voluntary Arrangements

(Insolvency Service)

We provide solutions to individuals throughout the UK, We Will help recommend solutions available to your circumstances in which you can then make an informed decision about which solution you qualify for is best for you and your circumstances.