Bankruptcy In UK

Bankruptcy is often seen as a last resort, and for many people facing overwhelming debt, it can feel like a frightening word.

A Debt Relief Order (DRO) can be a lifeline if you’re struggling with debt. At Advice Centre Group, we’re here to help you understand if this solution could be right for you.

A Debt Relief Order is a formal debt solution for individuals with low income, minimal assets, and relatively low debt levels. It provides a legal way to deal with unmanageable debts when you can’t afford to make payments.

With a DRO:

A DRO offers a fresh financial start with less cost and complexity without many of bankruptcy’s drawbacks.

You can qualify for a Debt Relief Order if all of the following criteria apply:

Life Changers

The advice centre helped me was I was on my last hope of anything… all staff were friendly understanding and couldn’t do enough to help me with my situation

Everything was done was sorted so quickly and easily…just two calls and my worries were over. I would definitely recommend them to anyone that’s in a difficult position

Now I live my life happy and worry free

Name changed for Privacy.

By submitting the above contact form you agree to be contacted by The Advice Centre regarding your enquiry. Your data will not be passed onto third parties without your consent.

Bankruptcy is often seen as a last resort, and for many people facing overwhelming debt, it can feel like a frightening word.

Some debts need to be dealt with immediately to avoid serious consequences. Others, while still important, don’t carry the same urgency.

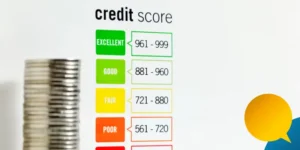

Concerned about your credit rating after entering an IVA? This guide explains what to expect and how to take control of your financial future.

Call us – 0161 768 8403

Email us – Enquiries@advicecentregroup.co.uk

You can visit the Money Helper website to find out more about managing your money and to get free advice, they are an independent service set up to help people manage their money

Advice Centre Group Ltd registered in England and Wales (14322979). Registered office: Second Floor A, Cheadle Place, Cheadle, Cheshire, England, SK8 2JX.

Adam Southard is authorised as a Licensed Insolvency Practitioner in the United Kingdom by the Insolvency Practitioners Association, We only provide advice after completing or receiving an initial fact find where the individual(s) concerned meet the criteria for one of our insolvency solutions, therefore, all advice regarding Individual Voluntary Arrangements (IVA) is given in reasonable contemplation of an insolvency appointment.

Adam Southard is licensed to act as an Insolvency Practitioner in the UK by the Insolvency Practitioners Association. Office Holder No. 11930

Insolvency Practitioner Directory- Insolvency Practitioner Details (bis.gov.uk)

What you need to know about Individual Voluntary Arrangements

(Insolvency Service)

We provide solutions to individuals throughout the UK, We Will help recommend solutions available to your circumstances in which you can then make an informed decision about which solution you qualify for is best for you and your circumstances.